By Joannes Vermorel, January 2023Resilience, from a supply chain perspective, is the capacity of a company to mitigate negative unplanned systemic events (or

shocks) that endanger the commercial flow of physical goods. These shocks can occur when a company loses the capacity to serve the goods (due to a negative supply event), or when it loses the clients for the goods (due to a negative demand event). Resilience is also characterized by a company’s capacity to return to the previous state of flow after the shock has ended. Overall, resilience is a desirable survival trait for a company, although

in the absence of shocks, resilience presents a competitive disadvantage as it entails a series of costs.

History

The term resilience was introduced about two centuries ago from a

strength of materials perspective. In “The Concept of Resilience”

[1], Alastair McAslan summarizes its origin:

The term resilience was introduced into the English language in the early 17th Century from the Latin verb "resilire", meaning to rebound or recoil (Concise Oxford Dictionary, Tenth Edition). There is no evidence of resilience being used in any scholarly work until Tredgold (1818) introduced the term to describe a property of timber, and to explain why some types of wood were able to accommodate sudden and severe loads without breaking. The understanding of the term “resilience” remained chiefly attached to its “strength of materials” origin until the second half of the 20th century, when the term was largely repurposed to clarify some abstract qualities attributed to

systems: organisms, ecosystems, communities, organizations, etc.

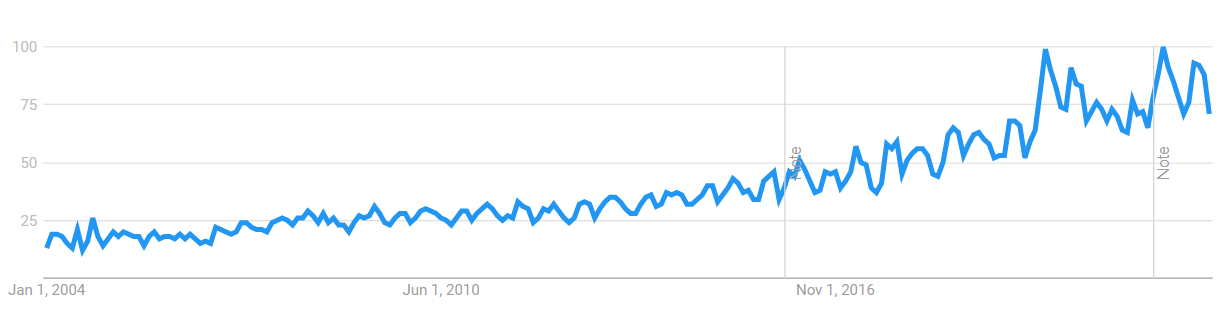

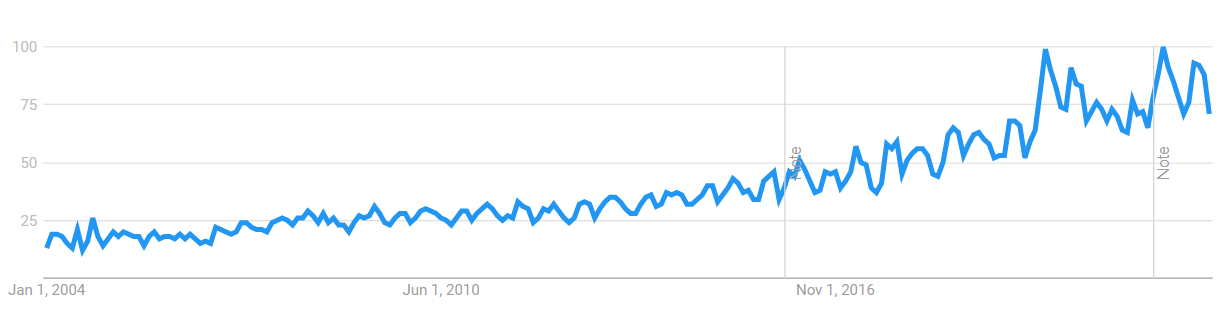

Since the early 2000s, the term has significantly grown in popularity, as illustrated by the Google Trends search data for “resilience” (as demonstrated in Figure 1).

Figure 1 Google Trends data for “resilience”, retrieved December, 2022.

The large-scale lockdowns of the 2020s, which disrupted (and in some countries continue to disrupt) numerous supply chains, resulted in modest spikes of general interest for the term, but these did not fundamentally alter its steady rise to prominence.

From the more specific supply chain viewpoint, in the early 2000s, a series of vendors started to promote

resilient supply chain solutions, implicitly redefining resilience through the lenses of their own solutions. In this regard,

resilience illustrates the established (and dubious) practice - among enterprise vendors - of repackaging older products and services with a new buzzword every couple of years.

A first overview of supply chain resilience

The qualifier ‘resilient’, when applied to a supply chain, must be made reasonably narrow and precise; otherwise, this qualifier devolves into what amounts to a synonym for a ‘superior’ supply chain. Conversely, a definition

in extenso through a shortlist of examples of negative events (e.g., lockdowns) is insufficient to make this concept worthy of interest for a supply chain practitioner.

We propose to define resilience as the capacity - for the company and its supply chain - to mitigate negative unplanned systemic events, simply referred to as

shocks henceforth. This definition intentionally excludes entire classes of negative events.

For example, a stockout is not a shock. It is a negative unplanned event, but it lacks the ‘systemic’ aspect. A stockout is a local problem, if not in a geographical sense, at least from an offering or merchandising perspective. Inflation, as a second example, is also not a shock. It is a negative systemic event, broadly impacting the company, its clients, and its supplier, but it is largely a planned event: inflation is the result of an increase of money supply, and central banks are not exactly secretive in this regard.

The element of surprise is, thus, in the eye of the beholder. Walking with his hands over his eyes, a man bumping into a tree can curse it for being an “unplanned” event in his journey, but this is still the result of intentional human action (he chose to cover his eyes and invited the possibility of a shock). From a supply chain perspective, shocks should only refer to the sort of events that

defy anticipation, at least considering the methods and the technologies available to the broader market.

Similarly, the systemic nature of a shock is contingent upon the organization in question. Case in point: a store owner losing his only location to a fire is right to consider this event a shock to his retail business. Per contra, a large retail chain might look at the same event as a minor impediment to hitting the next quarterly target. Therefore, an event qualifies as

systemic when it impacts a sizeable (and significant) portion of a system, here a supply chain, with immediate effect.

Regarding shocks, from a supply chain perspective, there are two broad categories:

supply shocks and

demand shocks.

Supply shocks endanger the continued capacity to service physical goods. Supply shocks can result from both external and internal forces; in the case of the former, natural disasters (such as a flood) or man-made ones (such as a war) can seriously shock a company’s flow of goods; in terms of the latter, a company strike or IT system meltdown can result in an equally serious shock.

Demand shocks endanger the continued interest of the market in the goods offered by the company. These shocks are usually driven by a sharp degradation of the public image of the company due to an accident (such as an airplane crash for an airline) or a scandal (for example, company fraud).

In sum, resilience refers not only to the company’s capacity to mitigate the immediate negative consequences of a shock,

but also its capacity to return to the previous state of affairs. Resilience is, by definition, a relatively desirable property for a company, as it increases its odds of survival in turbulent times. However, in practice, resilience almost invariably comes at a cost, as the company ends up preparing itself against classes of shocks that may or may not happen.

Path to resilience

There are two broad avenues to make a supply chain more resilient. First, turning unplanned events into planned ones. Second, turning systemic events into localized ones. We will discuss both paths in greater detail, but first a caveat: there is no free lunch here. Resilience, like most desirable traits for an organization, is achieved by way of a trade-off. Further, there are numerous bad processes and bad technologies that introduce accidental fragilities into a supply chain. However, resilience is typically not the appropriate remedy for these classes of problem, as they negatively impact the supply chain even in the absence of shocks, hence negative knowledge

[3] is a more suitable perspective to deal with these accidental fragilities.

From unplanned to planned

Turning unplanned events into planned ones is far from a novel idea. It revisits the age-old principle of hoping for the best while preparing for the worst. More specifically, from a supply chain perspective, most upcoming flow variations (varying demand, varying lead times, varying prices) can be anticipated but not accurately, especially when it comes to sudden acyclical variations

[a].

Probabilistic forecasting revisits the forecasting perspective with a different ambition: instead of attempting to eliminate the attendant uncertainty, the goal becomes to model and quantify the uncertainty itself. Probabilistic forecasting paves the way for stochastic optimization

[b] techniques that are used to compute risk-adjusted decisions. Risk-adjusted decisions make the supply chain more resilient because those decisions steer the company away from the worst outcomes. In practice, computing risk-adjusted decisions also requires a financial perspective on the supply chain. This financial perspective is used to define the loss function for the stochastic optimization.

Risk-adjusted decisions are usually more conservative, and thus less efficient, compared to decisions that merely ignore risk altogether. For example, a risk-adjusted inventory replenishment order may “opt-out” from a price break target - associated with a large minimal order quantity (MOQ) - as there is a small probability that the demand might collapse leaving the company with a major inventory write-off. Missing the MOQ is the price to be paid to mitigate the eventual impact of a demand shock.

Risk-adjusted decisions offer a path towards greater supply chain resilience while keeping the transformation largely reversible. In practice, it amounts to nudging (used here in the behavioral economics sense) all the mundane daily decisions, but alters neither the company nor its supply chain in any fundamental way.

If the company is willing to consider more structural transformations, then it can make itself more resilient by intentionally making numerous supply chain assets more versatile than they need to be – at least under normal circumstances. For example:

- Some French companies train their white-collar employees to supplement their blue-collar workforce in the event of a strike [5]. As strikes disproportionately impact the latter, the company can mitigate a strike by temporarily redeploying a large portion of its workforce to cover vacant positions. Should a strike occur, the company postpones important, but not urgent, white-collar processes (such as accounting, marketing, legal, etc.). Resilience is thus gained at the expense of lowered productivity for these white-collar workers, as they must be trained for tasks they do not routinely perform, and, for the company, the higher-order processes mentioned above go unfulfilled for the duration of the strike.

- The US army adopts diesel engines for nearly all its ground vehicles, including small cars and motorcycles – diesel engines being a relative rarity among their civilian counterparts. By using a single type of fuel, the US army eliminates entire classes of logistical problems. In addition, this creates the possibility, in emergency situations, of transferring fuel from any given vehicle to any other one. Resilience is gained, but at the expense of other factors, typically a higher price point for the engines for most small vehicles.

The transformations can almost always be seen as a trade-off where the company - and its supply chain - accepts a lower day-to-day efficiency in order to gain higher - but still degraded - efficiency under shock.

From systemic to localized

Turning systemic events into localized ones is frequently done through diversification, vertical integration, or consolidation.

Diversification can be performed on the demand side by extending the product range or by addressing new markets (e.g., different countries). The demand side diversifications that improve resilience tend to be the ones that do not introduce synergies. For example, selling a complementary product to the same market segment cannot make a company more resilient to a demand shock impacting this very segment. Diversification can also be performed on the supply side by leveraging suppliers that have overlapping capabilities and offerings. This supply side diversification is typically done at the expense of economies of scale and increases the overall operational complexity.

Vertical integration can be used to eliminate demand and supply side shocks. A manufacturer can acquire a retailer in order to secure a sales channel, thus mitigating demand shocks, as the manufacturer will not get delisted from its own retail channel. Conversely, a retailer can acquire a manufacturer in order to secure its supply, thus mitigating certain supply shocks, such as the manufacturer entering into an exclusive distribution agreement with a competitor. Over time, vertical integration tends to make the internal supplier less competitive than its external counterparts

[c].

Consolidation, typically executed through M&A (mergers and acquisitions) operations, is one of the “easiest” paths to resilience. By merging entities that used to be competitors, the newly formed company benefits from reduced competitive pressure, on both demand- and supply-sides. Competition is a major source of shock for companies, as competitors can trigger price wars (demand-side shock) and enter exclusive agreements with suppliers (supply-side shock). The primary downside to consolidation is that it usually yields diseconomies of scale, making the company even more vulnerable to market-wide disruption.

The upper limit of this approach appears to be achieving the

too big to fail status where the preservation of the company becomes a political affair, shifting the burden of the company’s survival from its original shareholders to taxpayers.

Resilience shenanigans

In supply chain, there is no solution without an agenda from its vendor

[2]. While it is old hat to remark that enterprise vendors repackage former products and services to match the latest buzzword or trend, it

appears that since 2020 many such solutions have also gained the preternatural ability to make supply chains more resilient. It is worth dedicating an entire section to debunking some of the most dubious claims

[d]. In no particular order:

Positive ROI claims are highly questionable, as nearly all corrective actions that make the company more resilient make it less efficient as well

[e]. After a shock, it is possible to speculate how much worse the situation would have been without the proactive corrective actions, but by design, direct measurements are impossible.

Supply chain visibility and real-time visibility do not do much as far as resilience is concerned. Shocks are not exactly subtle phenomena that elude “basic” measurements. Among all the shocks listed in the first section, none of them can be mitigated through a more fine-grained visibility of the state of the supply chain. Though supply chain visibility is desirable – in fact, instrumental in numerous supply chain optimizations — this concern is largely independent of resilience.

Workflows, by design, increase a company’s

efficiency while reducing its agility. In fact, a workflow anchors the company in its ways and methods, making it

more resistant to change. Thus, the notion that adding a software-supported workflow will increase resilience is an extraordinary claim that requires extraordinary evidence.

AI (artificial intelligence) technologies, as of 2022, remain resolutely statistical, at least for the mainstream flavors of AI, such as deep learning. Most systemic shocks should be expected to be unprecedented, thus companies should not expect to detect them within their (or relevant market) historical data. Granted, statistical analyses are of incontestable value for supply chains, however, the proposition that they (in their current iterations) can predict and/or mitigate shocks is either delusional or a gross mischaracterization of AI

[f].

Resilience is, inherently, a tough sell as it should be expected to lower the short-term and mid-term profitability of the company, while increasing its long-term survival odds. Any solution that promises a resilience “free lunch” – supposedly achieving gains on all fronts – is (very) probably too good to be true.

While undue skepticism delays innovation, healthy skepticism is necessary to avoid IT catastrophes routinely associated with the unwise adoption of buzzword-driven technologies and processes.

Beyond resilience

The intuitive opposite of ‘resilience’ seems to be fragility. While a resilient company mitigates the negative outcomes associated with a shock, a fragile company exacerbates those outcomes, effectively amplifying the shock. However, Nassim Taleb, in his book “Antifragile: Things That Gain from Disorder”

[4], proposes a radical alternative. He argues that the difference between fragility and resilience is merely a matter of degree, as shocks remain strictly detrimental, no matter if the system is deemed fragile or resilient.

Thus, Taleb introduces

antifragility as an abstract property that characterizes systems capable of bettering themselves under shocks. Taleb not only demonstrates that antifragile systems do exist, but also proposes that, in the long run, fragile and resilient systems alike are eventually replaced by antifragile ones. Fragile systems are replaced faster than the resilient ones, but eventually, resilient systems are also replaced.

From a supply chain perspective, an antifragile company should not merely mitigate shocks, but actively take advantage of them to outcompete its rivals. However, it is not clear that any degree of antifragility can be achieved by supply chain

in itself. Antifragility, in companies, first and foremost reflects a risk-taking entrepreneurial attitude, which cannot be meaningfully confined to a single (however large) division like supply chain. Also, antifragility is an even tougher sell than resilience as it typically involves taking more risks - not just accepting a lowered efficiency as is the case for resilience - in the short term in order to increase odds of long-term survival.

Lokad’s take

The mainstream supply chain perspective

[g] - both the theory and its software avatars - dismisses risk altogether. It makes supply chain fragile

by design. Mundane, largely predictable and volatile factors (e.g., varying lead times, fluctuating commodity prices, customer levels, supplier churns, etc.) are not even considered. The only source of uncertainty deemed worthy of a statistical analysis is the future demand, and even demand is approached with point time-series forecasts that dismiss uncertainty. Statistical analysis geared towards averages are the embodiment of the attitude

prepare for the best, ignore the worst. Moreover, optimization targets, expressed in percentages (e.g., service level, fill rate, MAPE), also dismiss risk, even when the risk is mundane and repetitive. Minor inconveniences get lumped together with major ones, but simple percentages do not reflect the true magnitude of the problems faced by the company.

Making a supply chain resilient is a tall order, but it cannot evade quantifying risk and uncertainty. The

Quantitative Supply Chain Manifesto was introduced by Lokad in 2017, years before “supply chain resilience” became a buzzword. On a technical level, it emphasizes probabilistic forecasting as an uncertainty-driven alternative to point forecasts. It also emphasizes economic drivers as a risk-driven alternative to KPIs expressed in percentages. Finally, as resilience is an elusive property, this manifesto proposes a simple mechanism to achieve in-depth supply chain improvement: freeing up management bandwidth

[6] as never-ending firefighting is antithetical to any serious, transformative fortification of one’s supply chain.

References

1 The Concept of Resilience, Understanding its Origins, Meaning and Utility, Alastair McAslan, March 2010

2 Adversarial market research for enterprise software, Joannes Vermorel, March 2021

3 Negative Knowledge in Supply Chain, Joannes Vermorel, March 2021

4 Antifragile: Things That Gain from Disorder, Nassim Nicholas Taleb, November 2012

5 La RATP attribue une prime annuelle de 1 200 euros à des cadres volontaires pour conduire pendant les grèves, Rodolphe Helderlé, Miroir Social, August 2011

6 Supply chain resilience requires bandwidth, Joannes Vermorel, December 2022

Notes

a Seasonality can lead to large variations of activity for the company, but those variations can be anticipated precisely due to the cyclical nature of the phenomenon.

b Stochastic optimization refers to a collection of methods for minimizing or maximizing an objective function when randomness is present. This concept is introduced in opposition to “deterministic optimization” that assumes that there is no randomness involved in the loss function.

c The automotive industry is the archetype of the early 20th century industries, where manufacturers started with extensive vertical integration but, by the end of the same century, manufactures had gradually externalized the bulk of their production to suppliers (as those suppliers were massively outcompeting them from a cost perspective). Aviation and personal computer manufacturing underwent similar transformations.

d It is entirely possible that those solutions may be desirable for reasons that have nothing to do with resilience.

e Resilience, while desirable, is not a goal in itself. For example, Venture Capitalists (VCs) usually lean strongly in the opposite direction: get big or die trying. This approach favors options that improve the efficiency of the company, hence its potential to become a massive success, at the expense of its odds of survival.

f Having human experts craft a numerical recipe to make a supply chain more resilient to a possible shock is a fairly reasonable proposition. However, qualifying such a numerical recipe as an “AI” construct is quite a stretch, and does not reflect the sort of techniques and algorithms that usually fall under the AI rubric nowadays.

g Point time-series forecasts, safety stock, and ABC analysis are notable examples of what could be considered the mainstream supply chain perspective.